Internet Cash: The Ongoing and Prospective Use of Public Private Partnerships to Build Infrastructure for Central Bank Digital Currencies (CBDCs)

Jordan Miller

Abstract: With the advent of virtual currencies, societies around the world have begun a monetary experiment whose scope and scale may prove to be unmatched in recent history. Alarmed by the rise of “cryptoassets” and a weakness in account-based services exposed by COVID-19, Central Banks are designing and deploying their own digital payment systems, known as Central Bank Digital Currencies (CBDCs), to capture the benefits of virtual money without relinquishing control of monetary or fiscal policy. Yet due to the complexity of building a digital ledger from scratch, many authorities have chosen to partner with private companies and nonprofits to construct the necessary payment rails, harnessing policy arrangements that mirror the DBfOM model of physical infrastructure development. Thus, this analysis examines the growth of these P3 arrangements among Central Banks, DLT/Blockchain providers and private companies in the CBDC space, beginning with a high-level overview of the architecture of DLTs. It then considers a framework for thinking about CBDCs and includes a benefit and risk comparison of developing virtual currency through a P3 arrangement. It further highlights ongoing projects adapting P3 policies and proposes ways that planners could embrace elements of the P3 lifecycle to achieve Value for Money. Finally, it closes with an accounting of the leading CBDC P3 projects in development today.

Introduction

With the advent of virtual currencies, societies around the world have begun a monetary experiment whose scope and scale may prove to be unmatched in recent history. The goal is nothing less than a complete transformation of the banking system; a largely analogue industry reliant on over $17 trillion dollars in deposits and a host of overdraft, ATM, and maintenance fees to remain profitable (Condon 2021). While hard bills and coins make up the lynchpin of this system today, the development of Distributed Ledger Technologies (DLTs); growing demand for faster, cheaper, and more accessible services and the resurgence of Great Power competition all threaten to flip this centuries-old banking paradigm on its head (Boon and Wilson 2020). Indeed, with the ongoing adaptation of the internet from niche technology to global tool, the disruptive power of digital innovation offers to supplant this paradigm with an open, frictionless, and virtual payment method at a time when satisfaction with legacy systems has reached a newfound low (JD Power 2020).

Alarmed by the rise of unregulated “cryptocurrencies” and a weakness in account-based services exposed by the COVID-19 pandemic, banking institutions worldwide are designing and deploying their own digital payment systems, known as Central Bank Digital Currencies (CBDCs), to capture the benefits of virtual money without relinquishing control of monetary or fiscal policy. However, due to the complexity of building a digital ledger from scratch, many authorities have opted to partner with private companies and nonprofits to construct the necessary payment rails. While such Public-Private Partnerships (P3s) are still in their early stages, these arrangements bear a striking resemblance to DBfOM (Design, Build, (Partly) Finance, Operate and Maintain) projects found more commonly in the physical infrastructure space. As P3s are best suited to transfer technological risks to the private operator through the use of long-term performance contracts, the CBDC industry may prove a fertile environment for the next wave of public-private development.

Therefore, the following analysis examines the growth of P3-like arrangements among Central Banks, DLT/Blockchain providers, and private companies in the CBDC space. This includes a high-level overview of the architecture of DLTs, a robust framework for thinking about CBDCs, and a benefit and risk comparison of developing virtual currency through a P3 arrangement. It then highlights ongoing projects adapting P3 processes and proposes ways that planners could embrace further elements of the P3 lifecycle to achieve Value for Money.

Distributed Ledger Technology (DLT)

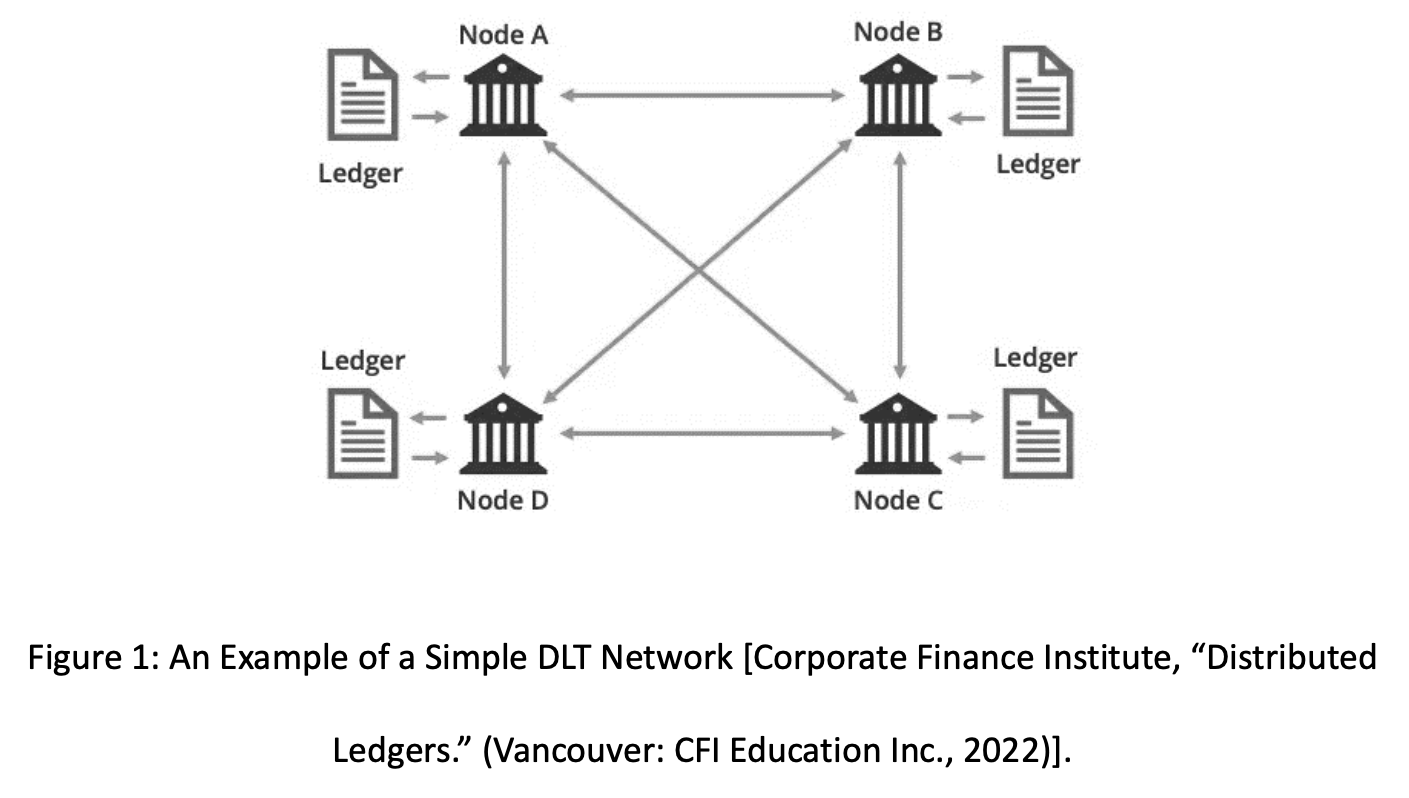

Much like the internet itself, a Distributed Ledger Technology (Fig 1) is a network of computers linked together through a shared set of communications rules, known as a “protocol.” While many different types of protocols exist, the most popular configuration is a “blockchain,” which uses software to host a massive balance sheet of incoming and outgoing transactions spread across all computers on the network. To make certain that every transaction is accurate, the blockchain determines how the computers on the network synchronize through a “consensus method,” which ensures that all copies of that ledger are identical and cannot be manipulated or overspent (Stellar Foundation n.d.a, 21). Depending on the consensus method used, each computer on the network may have the right to validate transactions and earn digital currency doing so through a variety of means, including competing with others to verify security or based on the amount of money wagered by each computer node (Stellar Foundation n.d.a, 21).

At their core, DLT systems are effective at determining “ownership” of the data sent between individuals, as the concurrent consensus means it is impossible to have more than one accurate ledger of data ownership at any one time (Stellar Foundation n.d.a, 5). To modify the network and send a transaction, the participant must sign and submit the information about their transaction to a computer node, which processes that information along with all the other nodes simultaneously in order to determine what amount of data has moved and to whom. Crucially, such systems do not need a central actor or authority to determine the ownership of assets, as all computers verify this at once (Lee, Malone and Wong 2020). Thus, while some blockchains are hosted by centralized parties, others are public and spread out globally, serving as an effective way to overcome geographic or trust barriers to commerce (Nelson 2021).

DLT systems rely on “tokenized” data to serve as the currency being transacted, which means that data on the network acts as a “representation of properties that attest to and transfer ownership” of wealth (Giancarlo et al. 2020, 10). In other words, much like physical tokens (i.e., dollar bills) that serve as representations of value in an economy, the data on the network is treated like a digital “coin” that is transacted back and forth in lieu of physical cash. Because the state of a well-designed DLT network cannot be altered fraudulently, there is no risk that a bad actor can “double-spend” any of the coins in their possession. However, unlike the digital account-based systems employed by most banks, the DLT system relies on the data being directly transferred across the network from one participant to another, rather than through the shifting of numbers between accounts by a central administrator (Giancarlo et al. 2020, 10).

Central Bank Digital Currency (CBDC) Definition

Because CBDCs remain in their infancy, Central Banks have proposed a number of models to meet the needs of perspective financial authorities. In general, all countries plan to use the ability of DLT networks to tokenize data in order to issue “coins” that represent a central bank liability, either for the use of the general public as a “retail CBDC” or for deposits between banks as a “wholesale CBDC” (Boon and Wilson 2021). Like cash, but unlike digital bank deposits, the inherent portability of a digital token allows the currency to be exchanged in real time cheaply, regardless of the physical location of the parties involved (Giancarlo et al. 2020, 11). At this level, a CBDC ledger (comprised of the DLT network itself) becomes the virtual balance sheet of the Central Bank, but also involves directly interacting with consumers through individual “wallet” programs in a way that Central Banks today do not (Bank of International Settlements 2020, 5).

Beyond their ease of use, these designs unlock a plethora of monetary functions unavailable with traditional currency. Programmability allows for synchronized payments and enables the creation of money that is automatically interest bearing without the need for accounts involved (Giancarlo et al. 2020, 11). CBDCs may also allow greater read and write privileges for third parties, permitting entities to offer financial services while the Central Bank reserves the right to issue the currency. There may also be social benefits to this system, as societies globally have seen a marked decline in the use and access to physical cash even as traditional electronic banking has not kept up with today’s 24/7 environment. Cross-border payments between nations represent a major pain-point for this industry as well, requiring costly fees and multiple days to complete transfers (Bank of International Settlements 2020, 7). Likewise, financial institutions struggle to serve the unbanked population, estimated at almost 14 million people in the United States alone (Baer 2021, 16).

However, it is important to note that the CBDC concept also suffers from certain drawbacks. Tokens have disadvantages to account-based currency in that they can be destroyed, with banks rarely obligated to replace ruined tender. Should a CBDC be lost or “burnt” (i.e., sent to the wrong address) for example, individuals may become the sole party responsible for that loss (Giancarlo et al. 2020, 19). In addition, while interest-bearing CBDCs may pass on rate changes directly to consumers and increase the versatility of money, this system requires competitive rates to bolster usage and could exacerbate financial instability. This paradigm shift also calls into question the continued role of commercial banks, as without direct customers the financial system may become “disintermediated” while exposing the Central Bank to destabilizing bank runs in times of crisis (Bank of International Settlements 2020, 8). Critics have also raised questions about the use of DLT technology to maintain such systems, as today’s configurations have high overhead costs and slow transaction times compared to centralized servers (Bank of International Settlements 2020, 8).

Harnessing the P3 Lifecycle

While countries like China have elected to build a CBDC system from scratch, the P3 project model offers considerable advantages for much of the world. In countries like the United States, technological innovation frequently occurs through partnerships between the public and private sectors, and globally governments and corporations are experimenting with tokenized commodities, contracts, and titles, showcasing the power of this joint approach to the digital age (Bank of International Settlements 2020, 5). There are also benefits to building a banking system that features “layers” of both CBDC and non-CBDC payment methods, as this arrangement can boost new innovation without compromising the rest of the system (Ripple Labs 2020, 12). Many private companies have developed successful commercial digital currencies in this vein already, and their know-how can help spin up such massive projects faster than starting from the ground-up. Of course, with each of these projects, the guiding principles must center on achieving Value for Money (VfM), Affordability, Commercial Viability, Manageability, and Acceptability.

In addition to designing and building such systems, there is considerable benefit for private or non-profit entities to operate and manage CBDCs well into the future. Unlike physical infrastructure which is often capital and/or labor-intensive but otherwise straightforward to run, digital platforms involve unique operating risks and cannot afford unintentional consequences or downtime. Such risks are particularly hazardous when digital systems are “at scale” (Dhar 2021). To eliminate risks, DLT technology benefits from the involvement of private enterprise in the act of “validating” the network. For example, while DLT networks are frequently validated through a number of public nodes (i.e., individual computers), a DLT network maintained by a private party can determine which other entities it wants included in the list of validators. The private party may choose to whitelist nodes from only central or commercial banks, or to consider including intergovernmental organizations or currency unions. This gives Central Banks the flexibility of using a distributed ledger to maintain its CBDC, while choosing who has a say in monetary policy and economic management in a way that public DLT/blockchains do not currently allow (Ripple Labs 2020, 12).

Feasibility and Procurement

Given the focus on CBDC creation among financial institutions, many countries have already begun to study the feasibility of adopting CBDCs. This is encouraging, because such studies are effective at screening out projects that lack a well-defined scope or that are incapable of success; a potential disaster when involved with something as important as the monetary system. Several high-profile feasibility studies are already underway in Sweden, Ukraine, and in the United States that plan for the involvement of the private sector.

In 2019, Sweden’s Riksbank established its own e-Krona pilot division to determine feasibility, assess proposals, and to investigate regulatory issues (Sveriges Riksbank 2021, 4). Likewise, since 2017, the National Bank of Ukraine has explored the use of a digital currency, noting that Kiev may achieve factors such as Value for Money, affordability, and viability with a “private version [run by the] Stellar Blockchain” (TAdvisor 2021). The US Federal Reserve maintains its own feasibility studies, most notably through Project Hamilton, to assess “the feasibility of the core processing of a central bank digital currency, while leaving substantial flexibility for the impact of future policy decisions” (Boon and Wilson 2021). Countries wishing to pursue a CBDC will need to engage in similar studies to ensure that they represent an appropriate monetary solution, either through existing P3 Units in government or within those spun up by Central Banks. Most importantly, they will need to determine whether a private DLT/blockchain is the best Value for Money compared with a state-constructed network.

Procurement is a crucial step in the beginning of any P3 project, as it increases competition and plays a role in selecting the most efficient infrastructure solution. With large technology projects in particular, proper procurement is needed for negating consequences that can be long-term and high impact. Selection criteria should therefore include previous experience, financial strength, cybersecurity expertise and original proofs of concept (Kiff et al. 2020a, 21-35). While the procurement process remains opaque for many ongoing CBDC projects, they are generally structured around the Expressions of Interest, Requests for Qualifications (RFQs), Requests for Proposals (RFPs) and officials closing familiar to any P3 infrastructure developer today.

The procurement process also plays an auditing role by revealing weaknesses to rivals that the technical partner may not want exposed. While public blockchains including Ethereum are open-source and lack proprietary designs, leaked information is a particular problem for corporate partners, and could affect bids by the Stellar, Ripple, Consensys, and R3 ecosystems. Nevertheless, certain projects have already begun to harness this RFP model to attract private interest in building their CBDC networks. For example, as part of an RFP cycle, the Central Bank of the Bahamas asked for an Expression of Interest when planning their Sand Dollar Digital Currency and received responses from over 30 interested private companies (NZIA Ltd. n.d.). In February 2020, Sweden’s Riksbank underwent a similar public procurement process and selected Accenture LLP to act as the P3’s technical solutions provider and long-term operator (Sveriges Riksbank 2021, 4).

Legal Framework and SPV Formation

Another crucial component is the P3 framework. Beyond instantiating organizational principles, frameworks ensure that the partnership has full legal backing, possesses a way forward for the project and limits potential corruption in the process. While not all countries possess laws that direct their P3 activities, frameworks can be crucial for ensuring that projects keep to a certain size and/or have a clear commitment from government.

In the case of CBDCs, a framework is necessary to ensure that the monetary system is allowed to undergo such a radical transformation. This is primarily due to Central Bank Laws (or, in the case of monetary unions like the Euro, treaties), which “organically” establish Central Bank entities, their decision-making bodies and the foundations of their capabilities and mandates (Kiff et al. 2020a, 13). If such laws proscribe the creation of a separate or altered currency, then a CBDC project is impossible. For example, by some analysis, the Federal Reserve lacks any legal authority to issue CBDCs without congressional mandate and would also need the agreement of the Treasury Department. In fact, the International Monetary Fund estimates that of the 171 Central Banks included in their membership, 61% are bound by laws that limit their ability to issue bank notes or currency. Only 21% of Central Banks possess a law directly allowing for the issuance of currency in digital format (Kiff et al. 2020a, 21).

Another matter involves the formation of Special Purpose Vehicles (SPVs) to run the private aspects of the P3 partnership, usually involving equity stakeholders. Determining the composition of these SPVs is of particular importance to a CBDC project, as the invested parties may include banks, private companies like Goldman Sachs, monetary authorities like the Bank of International Settlements or nonprofits (n.d.). Some public DLT systems are run by a novel entity known as a Distributed Autonomous Organization (DAO). Put simply, DAOs are massive internet cooperatives that harness DLTs to vote on monetary governance matters, such as raising interest rates or issuing new tokens. DAOs have only recently been recognized in certain jurisdictions (e.g., in Wyoming as a form of LLC), but will grow in importance as DLT technology spreads. Determining how such organizations will hold legal equity in future SPVs is a crucial area of focus for CBDC planners if they wish to harness public DLT systems, particularly if DAOs are not subject to the same liability and insurance considerations as other parties (Hackl 2021).

CBDC Design and Features

Most CBDC designs operate around five principles: Structure, Payment Authentication, Functionality, Access, and Governance (Bank of International Settlements 2020, 12). A distributed ledger can be centralized, decentralized or a distributed mixture of both, which might include individual balances stored on a card or in a cellphone wallet (Bank of International Settlements 2020, 12). Such features are not trivial either, as centralized ledgers require intermediaries to transfer liabilities, secure anti-fraud protection and develop network security. By contrast, decentralized networks may be easier to adopt in their current form but remove much of the ability of the Central Bank to verify the ownership of each account using KYC or AML systems (Bank of International Settlements 2020, 12). These factors are all important for determining whether the government has achieved its Value for Money by adopting a ready-built system from a private entity. Beyond these token-specific considerations, the structure of the CBDC (e.g., whether it is account-based, token-based or multifactor) determines the underlying data structure and how it integrates with other products in the financial ecosystem (Bank of International Settlements 2020, 12).

Examples of popular distributed ledger systems showcase some of these design considerations (Fig. 2). Publicly, the world’s leading settlement layer for digital assets today is Ethereum, an open DLT system that is free to integrate and allows for the development of specialized programs known as smart contracts that execute commands autonomously. The Bank of Israel in particular has experimented with using public Ethereum as a method to deliver its own CBDC (Huillet 2021). However, due to its popularity, Ethereum has also seen a massive surge in usage and a concurrent spike in fee congestion, making public DLT systems unlikely candidates for CBDC design in the near term as they lack commercial viability and manageability (BitInfoCharts 2021).

More likely, P3 partners will turn to advanced enterprise solutions built on top of permissioned versions of public blockchains, including Consensys’ Quorum platform and Corda built on top of Ethereum. In particular, Corda has designed its blockchain for larger volumes of transactions and includes smart contracts, distributed business logic for faster computing, network identity capabilities, and peer-to-peer scaling (R3 2021, 3). Another popular choice for CBDCs is Ripple Lab’s XRP network, which leverages a private version of their public DLT ledger to meet the needs of banking institutions (Team Ripple and Craig DeWitt 2021). Beyond privacy features that cannot be found on public blockchains, this DLT network is custom designed to handle high transaction volumes while remaining cost effective for banks and users (Team Ripple and Craig DeWitt 2021). In some other instances, governments may elect to rely on completely private digital currencies known as “stablecoins” issued by companies; though these and other “synthetic” CBDCs pose risks that may fail acceptability and manageability tests (Bank of International Settlements 2020, 14).

Construction of the Network

As critical infrastructure, CBDC systems will need to be similar-enough to current payment systems for users to employ while also resilient enough to operate “24/7/365.” DLT systems offer significant resilience benefits to centralized services that can fail accidently or through malicious action, though a suitably hardened centralized server may be able to do the same (Bank of International Settlements 2020, 14). While DLT systems are mostly virtual technology that run as “software” on the cloud, physical internet infrastructure is necessary to host the computer nodes that make up the DLT network. Banks may wish to outsource this responsibility to major hosting companies such as Amazon Web Services but will need to maintain a diversified list of providers to prevent failure or malicious activities that could compromise the network.

The DLT system will also need to be able to handle a massive volume of transactions per second at a justifiable cost for the public partner. The private party will also need to build the system so that individual node-level failures are isolated and avoid a cascade across the platform. Likewise, systems that feature wholesale CBDCs between local (or even international) banks must be compartmentalized to prevent a failure at one bank from impacting the operation of other banks on the network (Bank of International Settlements n.d.). This presumes that the hardware and software on which the network is built do not suddenly grow obsolete as new technologies appear, which has been of particular consideration for blockchain networks that switch to different “consensus mechanisms” and raises concerns about component lifespan.

For private parties developing DLT networks from scratch, the demands are even greater still. Crucial components include physical computer infrastructure, storage space, network bandwidth, basic peer-to-peer network rails, encryption, smart contract functionality and an easy-to-use front-end (Davies n.d.). Finally, users will need to interact with a “digital wallet” application to send money and pay on the network, either on a desktop or mobile device. Building these software applications from scratch can take up to a month before testing, and rely on programming languages like Java, C++, Python or Solidity (Davies n.d.). With such hefty requirements, banks are likely to determine that they can find the best VfM through partnerships with private parties or non-profits who are willing to license pre-built DLT systems.

Cost, Funding, and Financing

Costs and financing for P3s depend on the capital of the initial investment, followed by the projected income minus operating expenses. Because DLT systems are currently in testing, financial analysis of such projects remains largely speculative. As noted by the Bank of International Settlements, CBDC systems require large capital expenditures and impose significant running costs in computer hardware, electricity, and cooling at the outset. Indeed, deciding who is responsible for financing has major implications for the entire network, as well as its efficiency, competition, innovation, and inclusiveness (2020, 13).

Instead of paying the costs itself, the public sector benefits from financing initially provided by banks or private investors in a P3 arrangement but must also conduct the cash flow analysis necessary to ensure the project is viable. The public party does this through a Net Present Value estimation based on the Discount Rate, which identifies the future revenues and costs of the project that the public sector must contribute through steady payments. This is opposed to funding the project immediately with public funds, a scenario represented in the analysis by the Public Sector Comparator (PSC) (Office of Innovative Program Delivery 2012, 2).

Payments to investors and financial institutions may take one of two models: availability payments or usage fees. For example, the Central Bank may wish to pay providers based on the availability of the network (including lack of any disqualifying “charge events” such as theft, network downtime etc.). In this case, government revenues would come from taxes on citizens, likely also recouped in the form of a CBDC. Alternatively, they may wish to charge fees for usage of the CBDC network as a toll, an element which has the added benefit of preventing spamming. However, the Central Bank must decide whether it wants to charge fees to the users, the merchants, or both, and take note of whether this discourages usage.

As CBDC projects are closest to the traditional DBfOM model, it is likely that some (or perhaps most) financing will come from the public sector. If the government does not include some form of subsidization, it may need to rely on private cross-subsidy or allow access to the monetization of consumer data to increase revenues, something which raises considerable privacy concerns (Bank of International Settlements 2020, 13). When partners require credit enhancement, particularly in developing countries, benefits may originate from proximity to the country’s Central Bank, which is often one of its most stable financial institutions. However, because such projects are new, there are also currently no official estimates on the cost of these systems to lenders. The public sector may be able to calculate this based on the amount saved from abandoning paper currency, with net costs borne by the taxpayer and recouped through lower remittances to the Treasury (Bank of International Settlements 2020, 15). The best estimate for today’s small public blockchain projects ranges from $6.3m to $33m but will likely be far higher, and comes down to network design, as well as the number of companies invested in each project (currently 12-15 on average) (Morris 2019).

The firm Blockchain Business Consultants suggest employing Multi-Criterion Decision Analysis to determine whether the project will have a sustainable Return on Investment (ROI). This is similar to the cost analysis performed in P3 arrangements and involves a range of ROI estimates ideal for highlighting intangibles and uncertainties (Miller 2019). This score is then compared to the Public Sector Comparator (PSC), which features the hypothetical risk-adjusted cost of a public sector version of the project. Ultimately, the P3 has a positive VfM if the partnership has a lower risk-adjusted cost than the PSC.

Note on Value for Money

While the VfM estimates made by governments are not yet public record, external entities have attempted similar studies. For example, Harvard Business Review suggests that switching to a CBDC-based banking system might save up to $750 billion per year (Mookerjee 2021). Of course, much of this benefit will depend on the style of CBDC network and what estimates the Bank includes in a PSC. A direct CBDC model built and operated entirely by the Central Bank is likely unworkable, as it requires the Bank to maintain daily functioning through customer service, Anti-Money Laundering and Know Your Customer (AML/KYC) measures, transaction verification and even dispute resolution. For perspective, the 17 largest banks employ over 14,000 people in AML/KYC compliance alone, with an industry total nearer to 20,000. If nationalized, this workforce would require a department the size of the US Dept of Energy (Baer 2021, 5). With this in mind, the CBDC system will likely need to incorporate banks into the SPV to handle such concerns while serving as an outside interface for customers, letting private entities handle network operations and the Central Bank manage issuance.

Operations and Stakeholder Governance

Operation of the network falls to the entities hosting the virtual nodes making up the DLT network, and also depends on the type of Consensus Mechanism employed. Recall that in public DLT systems, anonymous computers work simultaneously to verify the token ledger and receive a “reward” in the form of a digital token when they do so. However, with the Central Bank as the only party issuing new CBDCs, systems like Stellar base their operation and security off a different set up assumptions: that issuers will want to secure their own assets without relying on anonymous public validators, and issuers will have a strong desire to interoperate with the world and therefore will not “cheat” about the state of their ledger (Stellar Foundation n.d.a, 3). Banks and payment services providers will run their own nodes in this system while requiring a say in who runs the other nodes on the network, likely on large server farms with added resilience to the electrical grid, mobile networks, and internet connectivity (Bank of England 2020, 19).

As mentioned previously, a fee structure to use the network will serve as a way for payment service providers, such as wallet designers and network operators, to continue to recoup costs and maintain the integrity of the CBDC. Some may seek to provide payment services and even take losses on these activities if it reduces third party payment costs in their core businesses or attracts new customers, though it is crucial that these providers be transparent (Bank of England 2020, 19). For example, Visa has recently announced that it will incorporate payment rails for a host of digital currencies and will allow transfers as part of a broader ecosystem of CBDCs (Roberts 2021).

Of course, the Bank of England notes that payment service providers will need to provide “value-add services” which can make up for any fees they are charged by the network (Bank of England, 2020, 6). The Central Bank itself will use these fees as a cash flow to pay off the public and private sector loans that it has obtained, much as in any other infrastructure project (Bank of England 2020, 29). At present, the Ethereum network brings in $49 million in fees per day, which will likely scale as usage increases (Vasile and Nambiampurath 2021). However, fees will need to be moderate to prevent anger from stakeholders such as users or businesses, while meeting the financial needs of the Central Bank and the network operators.

Another crucial component of operation in DLT systems is governance. This involves determining any changes made to the software or hardware of the network in addition to complex fiscal and monetary changes. Indeed, because the system has multiple nodes not controlled by a single entity (particularly when structured as a DAO), the network must engage in various governance processes such as voting on proposals and forking software to make sure all nodes are running securely. It is likely that most of these parties will be present in the SPV created prior to project initiation, and that voting will resemble governance at public entities. However, governance processes may also need to feature buy-in from internal stakeholders like a nation’s Ministry of Finance, as well as external stakeholders including ISPs running hardware.

Auditing and Maintenance

Maintenance of the CBDC will be the responsibility of the private or non-profit partner and will need to include upkeep of software and hardware, as well as cybersecurity measures. The design of DLTs allows for various nodes to be taken down and serviced without disruption of the entire network, even though simultaneous software updates present a more in-depth challenge. Particularly on CBDC networks where the Central Bank provides availability payments to the private party, Key Performance Indicators (KPIs) will serve as a crucial external measure to hold network operators accountable, in addition to penalties imbedded in certain Consensus Mechanisms. KPIs may include network uptime, network congestion and the availability and security of smart contracts deployed on the system. Failures in any of these metrics would be deducted from the payment each period. In cases where CBDCs replace the current cash system, money may be reallocated toward servicing the CBDC network.

Auditing is a valuable part of the maintenance cycle as well, and depends on operators reporting specific performance indicators, audits, and contract changes to a system’s stakeholders. While too many audits can be stifling in P3 development, blockchain and other DLT systems excel at providing a trustless system that allows any knowledgeable individual to view transactions and macro-activity on the network in real time. However, while this concept works for public blockchains today, it may raise concerns from a business privacy or national security perspective when hostile actors can observe Central Bank activity. While it is a misconception that DLT networks allow for “anonymous transactions” there are also methods to determine which wallets on the network represent various entities (Huxley 2019). Notably, enterprise systems such as Consensys’ Quorum allow for real time auditing using software dashboards and can harness Oracle APIs to report on-chain events (Nelson 2021). Other cryptographic technologies, using “zero-knowledge proofs”, may allow auditors and law enforcement to verify the accuracy of transactions without revealing them directly.

Host countries will likely need to change their political governance, regulatory, accounting, and financial reporting standards in order to account for CBDC maintenance. As noted by the Bank of Sweden, the arrival of a CBDC will also have major impacts on public agencies, such as financial intelligence organizations and consumer protection bodies, merchants, and users. The host government may wish to set up a form of “national consultative committee” to provide outside auditing of the system and further communication between stakeholders (Kiff et al. 2021a, 19). Constant interaction with utilities will also be necessary, as outages in the system could prove economically disastrous and are not unheard of in today’s DLT networks (Ossinger 2021).

Leading Examples of P3 CBDC Development

United States (Project Hamilton, Digital Dollar Pilot)

The US Federal Reserve has initiated “Project Hamilton,” a partnership between the Boston Fed and Massachusetts Institute of Technology (MIT), on May 27, 2021, to build and test a CBDC designed for a “widescale, general purpose” (Reynolds 2020). Former Fed Governor Eric Rosengren anticipated that the Boston Fed would release a working paper by Q3, 2021; however, publication is still pending. The second project, known as the Digital Dollar Project, features a partnership between consultancy Accenture and the Digital Dollar Foundation. The stated goal is to “future proof the dollar” as the global reserve currency, engaging Accenture as a lead architect (Boon and Wilson 2021).

The Bahamas (Sand Dollar)

The Central Bank of the Bahamas has moved to develop a CBDC of its own, known as the Bahamian Sand Dollar. According to its project partners, the goal is to modernize the country’s digital payment capabilities, to increase transactional efficiencies and reduce service costs. After an RFP process, the Central Bank selected NZIA Limited to serve as a solutions provider in a long-term, performance contract. Other stakeholders include IBM and Zynesis, who both plan to use their experience in IoT and communications to this token with fast payment rails while integrating legacy systems (NZIA Ltd. n.d.).

Australia, Malaysia, Singapore and South Africa (Cross Border CBDC)

Because there currently exists no wholesale international platform for payments and settlements cross-border, these Central Banks have partnered to create a platform that allows them to pay each other in different currencies. This would feature multiple Central Banks issuing their own tokens, which commercial banks could then transact, while still giving Central Banks autonomy within their universal platform (Bank of International Settlements n.d.). The project will build on the Consensus Quorum enterprise version of Ethereum and R3’s Corda platform, featuring support from DBS, JP Morgan and Temasek, and is designed with strict access controls for each bank’s systems (Bank of International Settlements n.d.).

Sweden (e-Krona)

Sweden’s Riksbank announced the creation of an e-Krona pilot program in 2020, partnering with Accenture to construct a technical platform. The e-Krona circulates on R3’s Corda permissioned blockchain, with the Riksbank able to whitelist users on and off the network. Participants, who currently include banks and payment service providers, can run their own nodes validating transactions while requesting insurance of the token from the Riksbank. In this system, commercial banks would distribute the CBDC and execute transactions for end-users (Sveriges Riksbank 2021, 7).

Ukraine (e-Hryvnia)

In January 2021, Ukraine’s Ministry of Digital Transformation announced an agreement with the non-profit Stellar Development Foundation to build a CBDC. A signed MOU indicates that the partnership will work toward cooperation in the development of virtual assets (TAdvisers 2021). Ukrainian authorities intend to build their e-Hryvnia on top of the Stellar Blockchain starting April 2021 (TAdvisers 2021).

Cambodia (Project Bakong)

In October 2020, the National Bank of Cambodia (NBC) announced the Bakong in partnership with Japanese technology firm Soramitsu using the open-source Hyperledger Iora blockchain (Takemiya 2021). This “quasi-CBDC” will include digital versions of the Khmer Riel and US dollar that represent deposits held in the NBC vault and should be available for both wholesale use by banks and retail use in everyday transactions. NBC will run the core of the system, which employs “payment gateways” that connect to all other users and institutions (Takemiya 2021).

Conclusion

While the race to build a working CBDC could prove only the opening salvo in a full-blown monetary revolution, how these future payment systems function and what benefits and challenges they possess continues to be a matter of much speculation. What is certain, however, is that Central Banks are eager to leverage the DLT-based CBDC model to achieve faster transaction and settlement times, broadened financial services access, and maintain greater control over programmability to stay relevant in today’s digital world. Even so, there remain serious concerns about the costs of such projects, the manageability of token-based systems and the currency’s safety and security. Although each CBDC project has its own features, this analysis has demonstrated the suitability of P3 arrangements to enacting CBDC partnerships, showcasing the features that ensure further Value for Money, affordability, viability, manageability and acceptability without putting the burden on government.

While some countries like China have opted to develop CBDC networks within their own public sectors, many other Central Banks will no doubt choose to establish P3 partnerships because of their unique innovation and risk transference qualities. Indeed, structured as a DBfOM, such projects have already begun to harness the power of the P3 lifecycle, working out the finer points of procurements, systems design, construction, public and private financing, operations and maintenance. Whether the U.S., Ukraine, the Bahamas, Cambodia or other featured nations take up these stated recommendations and remain the frontrunners in the CBDC race is unclear at present. Nevertheless, these projects reveal just how relevant P3s continue to be for technological innovation, especially in this newfound age of internet cash.

+ Author biography

Jordan Miller is an edge technology policy specialist with a background in blockchain/Web 3.0, Big Data, AI, and battery innovation. He is currently a candidate for a Masters of Policy Management at the Georgetown McCourt School of Public Policy, president of the Georgetown Technology Policy Initiative (GTPI), and a published contributor on blockchain and Web 3.0 in Georgetown's Public Policy Review. He graduated from the University of Pennsylvania in 2017, where he was a Leonard M. Tannenbaum Public Policy Fellow. Until September 2021, Jordan served as the Staff Assistant for the Office of the Chief Economist at the International Monetary Fund, focusing on blockchain/Central Bank Digital Currencies, vaccine supply chains and digitization projects. He has also conducted cybersecurity and AI policy research at both CSIS and the German Marshall Fund, produced autonomous vehicle guidance at the Obama White House, and led battery electric vehicle deployments at the Center for Transportation and the Environment.

+ Footnotes

+ References

Accenture Federal Services. 2021. Digital Dollar Project to Launch Pilot Programs to Explore Designs and Uses of a U.S. Central Bank Digital Currency. Accenture Newsroom. Accenture Federal Services, May 3, 2021. https://newsroom.accenture.com/news/digital-dollar-project-to-launch-pilot-programs-to-explore-designs-and-uses-of-a-us-central-bank-digital-currency.htm.

Baer, Greg. 2021. Central Bank Digital Currencies: Costs, Benefits and Major Implications for the U.S. Economic System. Bank Policy Institute, April 7, 2021. https://bpi.com/central-bank-digital-currencies-costs-benefits-and-major-implications-for-the-u-s-economic-system/.

Bank of England. 2020. Discussion Paper Central Bank Digital Currency Opportunities, challenges and design. Bank of England. https://www.bankofengland.co.uk/-/media/boe/files/paper/2020/central-bank-digital-currency-opportunities-challenges-and-design.pdf?hash=DFAD18646A77C00772AF1C5B18E63E71F68E4593&la=en.

Bank of International Settlements. 2020. Central Bank Digital Currencies: Foundational Principles and Core Features. Bank of International Settlements. https://www.bis.org/publ/othp33.pdf.

——— . n.d. “Project Dunbar: International Settlements Using Multi-CBDCs.” BIS. The Bank of International Settlements. https://www.bis.org/about/bisih/topics/cbdc/wcbdc.htm.

Boone, Christopher L, and Ed Wilson. 2021. “Federal Reserve Dives Deep into Central Bank Digital Currencies.” Blockchain Report, Venable LLP, 27 May 2021, https://www.lexology.com/library/detail.aspx?g=62e5b8c9-fce1-4e25-805a-2e7cdc336e3d.

BitinfoCharts. 2021. “Ethereum Avg. Transaction Fee Chart.” BitInfoCharts. BitInfoCharts. Accessed December 3, 2021. https://bitinfocharts.com/comparison/ethereum-transactionfees.html#3y.

Condon, Christopher. 2021. “Why Wallstreet Is Afraid of the Digital Dollar.” Bloomberg Business Week. July 15, 2021. https://www.bloomberg.com/news/articles/2021-07-15/cryptocurrency-why-wall-street-is-afraid-of-government-backed-digital-dollar.

Corporate Finance Institute. n.d. Distributed Ledgers. CFI. Corporate Finance Institute. Accessed November 30, 2021. https://corporatefinanceinstitute.com/resources/knowledge/other/distributed-ledgers/.

Davies, Aren. n.d. “How Much Does It Cost to Build a Blockchain Project?” DevTeam.Space, November 15, 2021. https://www.devteam.space/blog/how-much-does-it-cost-to-build-a-blockchain-project/.

Dhar, Vasant. 2021. “Why the US Needs Public-Private Partnerships for Digital Infrastructure.” The Hill, August 7, 2021. https://thehill.com/opinion/technology/566738-why-the-us-needs-public-private-partnerships-for-digital-infrastructure.

Giancarlo, Charles H, J. Christopher Giancarlo, Daniel Gorfine, and David B. Treat. 2020. Working paper. The Digital Dollar Project: Exploring a US CBDC. Accenture and the Digital Dollar Foundation. May 2020 http://digitaldollarproject.org/wp-content/uploads/2021/05/Digital-Dollar-Project-Whitepaper_vF_7_13_20.pdf.

Huillet, Marie. 2021. “Bank of Israel Steps up CBDC Efforts with Reported Tests on Ethereum.” CoinTelegraph, June 23, 2021. https://cointelegraph.com/news/bank-of-israel-steps-up-cbdc-efforts-with-reported-tests-on-ethereum.

Huxley, R.R. 2019. “Are Your Blockchain Transactions Truly Anonymous?” Irish Tech News. Infused Media Group, March 5, 2019. https://irishtechnews.ie/are-your-blockchain-transactions-truly-anonymous/.

Kiff, John, Jihad Alwazir, Sonja Davidovic, Aquiles Farias, Ashraf Khan, Tanai Khiaonarong, Majid Malaika, Hunter K. Monroe, Nobu Sugimoto, Harvé Tourpe and Peter Zhou. 2020a. “A Survey of Research on Retail Central Bank Digital Currency.” IMF Working Papers 20, no. 104. https://doi.org/10.5089/9781513547787.001.

Kiff, John, Jihad Alwazir, Sonja Davidovic, Aquiles Farias, Ashraf Khan, Tanai Khiaonarong, Majid Malaika, Hunter K. Monroe, Nobu Sugimoto, Harvé Tourpe and Peter Zhou. 2020a. “A Survey of Research on Retail Central Bank Digital Currency.” IMF Working Papers 20, no. 104. 13, Table 1. https://doi.org/10.5089/9781513547787.001.

Lee, Alexander, Brendan Malone, and Paul Wong 2020. "Tokens and accounts in the context of digital currencies," FEDS Notes. Washington: Board of Governors of the Federal Reserve System, December 23, 2020, https://doi.org/10.17016/2380-7172.2822.

Miller, Dr. Drew. 2019. “Assessing the Return on Investment (ROI) of Blockchain Applications.” Medium HackerNoon.com, April 8, 2019. https://medium.com/hackernoon/assessing-the-return-on-investment-roi-of-blockchain-applications-29a3ec39af04.

Mookerjee, Ajay S. 2021. “What If Central Banks Issued Digital Currency?” Harvard Business Review. Harvard Business Publishing, October 15, 2021. https://hbr.org/2021/10/what-if-central-banks-issued-digital-currency.

Morris, Nicky. 2019. “The Cost of Enterprise Blockchain Membership.” Ledger Insights - enterprise blockchain, Ledger Inc., January 29, 2019. https://www.ledgerinsights.com/enterprise-blockchain-cost/.

NZIA n.d. “NZIA Limited Identified as Preferred Technology Solutions Provider by the Central Bank of The Bahamas for Digital Currency Project.” NZIA. NZIA Ltd., n.d. NZIA. Accessed November 30, 2021. https://nzia.io/pr/central-bank-of-the-bahamas/.

Office of Innovative Program Delivery. 2012. Office of Innovative Program Delivery, Value for Money Assessment for Public-Private Partnerships: A Primer. Federal Highway Transit Administration. Department of Transportation. https://rosap.ntl.bts.gov/view/dot/29043.

Ossinger, Joanna. 2021. “Solana Promises 'Detailed Post-Mortem' After 17-Hour Outage.” Bloomberg.com. Bloomberg, September 15, 2021. https://www.bloomberg.com/news/articles/2021-09-16/solana-network-of-top-10-sol-token-applies-fixes-after-outage.

JD Power. 2020. “Retail Banks Face Major Customer Satisfaction Challenge as World Shifts to Digital-Only Engagement, J.D. Power Finds.” The PayPers, April 30, 2020. JD Power and Associates. https://thepaypers.com/online-mobile-banking/retail-banks-face-customer-dissatisfaction-because-of-digital-only-engagement-shift--1242149#. R3. 2021.

Corda: Build Fast with Confidence. New York City, NY: R3, 2021. https://www.corda.net/wp-content/uploads/2021/10/Corda_Overview_2021_R3.pdf

Reynolds, Tracey. 2020. “The Federal Reserve Bank of Boston Announces Collaboration with MIT to Research Digital Currency.” Federal Reserve Bank of Boston. United States Federal Reserve, August 13, 2020. https://www.bostonfed.org/news-and-events/press-releases/2020/the-federal-reserve-bank-of-boston-announces-collaboration-with-mit-to-research-digital-currency.aspx.

Ripple Labs. 2020. The Future of CBDCs: Why All Central Banks Take Must Action. Ripple Labs. https://ripple.com/wp-content/uploads/2021/01/cbdc-whitepaper-2020.pdf.

Team Ripple, and Craig DeWitt. 2021. “Bhutan Partners with Ripple to Leverage CBDC Solution.” Ripple. Ripple Labs, November 8, 2021. https://ripple.com/insights/bhutan-advances-financial-inclusion-and-sustainability-with-ripples-cbdc-solution/.

Roberts, Jeff John. 2021. “Visa Unveils 'Layer 2' Network for Stablecoins, Central Bank Currencies.” Decrypt. Decrypt, September 30, 2021. https://decrypt.co/82233/visa-universal-payment-channel-stablecoin-cbdc.

Stellar Foundation. n.d. Stellar for CBDCs. San Francisco: Stellar Foundation, 21. Accessed November 30, 2021. https://resources.stellar.org/hubfs/Stellar_CBDC_Whitepaper.pdf.

Stellar Foundation, n.d. A Sample CBDC Implementation on Stellar. This Is a 2-Tier Model, for Which Many Central Banks Have Expressed a Preference. A 1-Tier Model, in Which the Central Bank Distributes CBDC Directly to Consumers, Could Be Implemented on Stellar as Well. Stellar CBDC Whitepaper. Accessed November 30, 2021. https://resources.stellar.org/hubfs/Stellar_CBDC_Whitepaper.pdf.

Sveriges Riksbank, 2021. “E-Krona Pilot Phase 1.” Working Paper, Sveriges Riksbank. https://www.riksbank.se/globalassets/media/rapporter/e-krona/2021/e-krona-pilot-phase-1.pdf

TAdviser. 2021. “Employees of the Ministry of Digital Affairs Are the First in Ukraine to Begin to Receive Salaries in Digital Hryvnias.” TAdviser.ru. TAdviser, 2021. https://tadviser.com/index.php/Project:Digital_hryvnia_(e-hryvnia).

Takemiya, Makoto. 2021. “Is Cambodia's Bakong the Future of Digital Currencies?” World Economic Forum. WEF, August 30, 2021. https://www.weforum.org/agenda/2021/08/cambodias-digital-currency-ishowing-other-central-banks-the-way/.

Vasile, Iulia, and Rahul Nambiampurath. 2021. “When Are Ethereum Gas Fees Lowest?” BeInCrypto. BEINNEWS ACADEMY LTD, October 12, 2021. https://beincrypto.com/learn/ethereum-gas-fees-lowest/.